US Real Estate No Longer Affordable

Why the United States' Real Estate Market is in Serious Trouble Ahead in 2023 & 2024

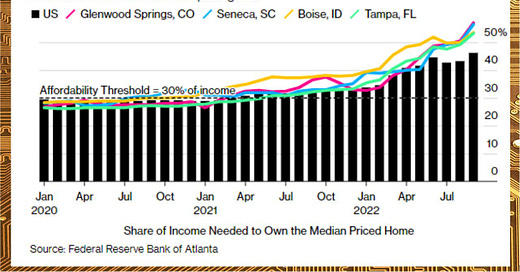

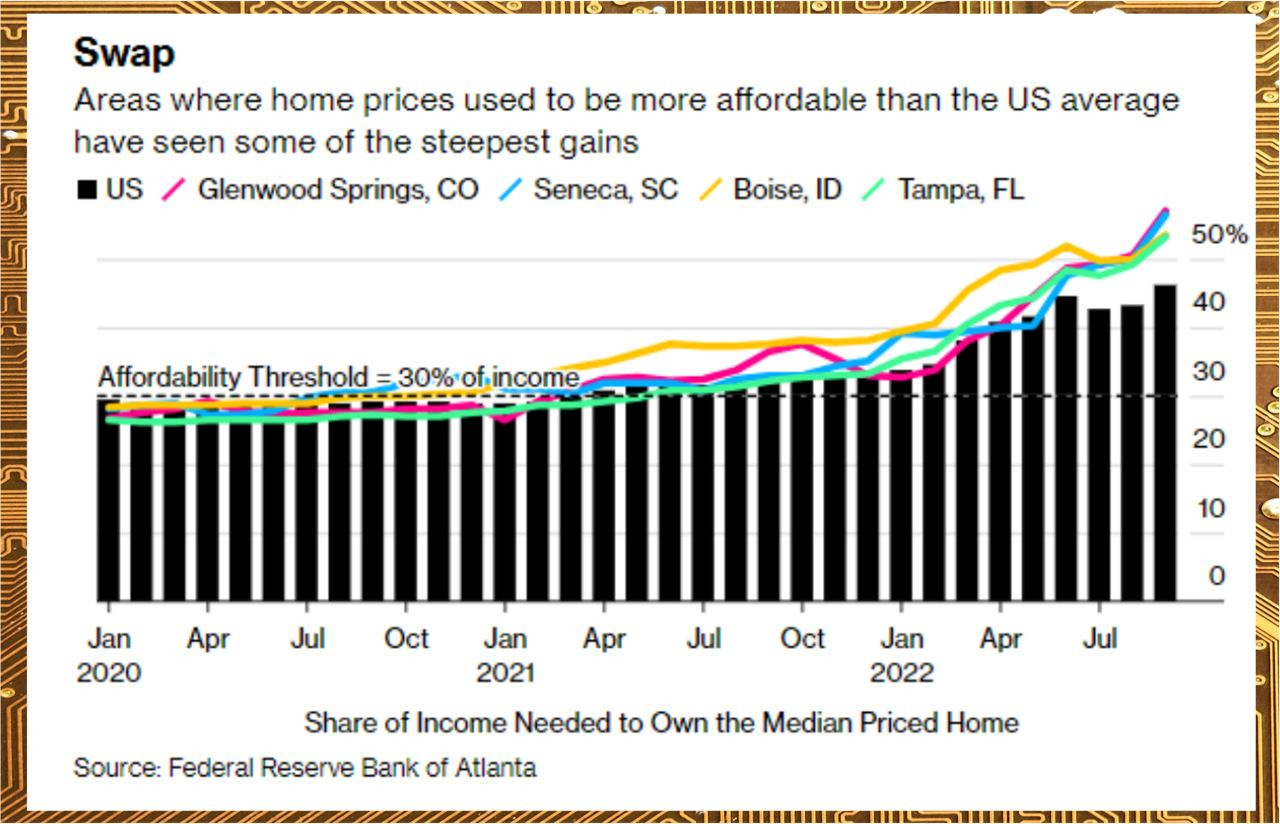

With private incomes stagnating & repayment rates rising massively as a result of the key interest rate hike, fewer & fewer American citizens can afford to buy their own home.

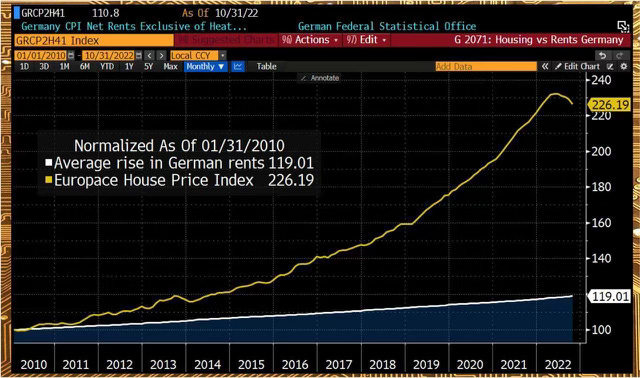

This is a dynamic that can also be expected in Canada & Germany.

Especially now, it is anything but advisable to get into debt on a single family home.

Anyone who thinks that taking on new debt in times of high inflation rates is a “good idea” is seriously mistaken.

In America, monthly repayments have doubled.

Those who suddenly can't afford the doubling monthly payment are watching the home being paid off go into the lender's assets. Many new home buyers that fall into the Gen Z category will soon either default on their mortgage loans, fall into bankruptcy, get foreclosed on, or sell their single family home for a smaller & less expensive home due to the inability to keep up with payments. Recent home buyers could also be forced into selling the single family home to move into an apartment and/or condo to avoid the high interest payments, high mortgage costs, and increased maintenance, utilities, and energy costs.

Young millennials & Gen Z are expected to experience severe financial hardship in 2023 & 2024 until the United States experiences some financial stability & successfully overcome the great reset as this recession continues to loom since the start of Covid in October of 2019.

Those who know how to take advantage of market cycles will benefit from these events that are slowly unfolding before our eyes. Those who don’t should prepare to see their salary, savings & their net worth become depleted/exhausted from rising hyper-inflation. Act now & start strategizing your financial blueprint before it’s too late and the great reset completely wipes you out.

It is now more profitable to buy a 6 month treasury bill than to own US Real Estate.

There are roughly 20 million rental properties in the United States containing roughly 48 million units.

It’s a Fact That the US Real Estate Market is on a Horrific Downward Trajectory

Even if it remains Dr. Michael Burry's secret for the time being whether he is again betting (shorting) on falling prices in the real estate market, the timing could hardly be better.

Rising interest rates of the central banks cause an absolute demand low on the global real estate market. At the same time, the monthly repayment rates of the loans to be paid off are rising. Unattractive conditions for real estate investors.

These Latest Interest Rate Hikes in 2022 Shows Effect

Even the Federal Reserve was unable to decisively reduce the inflation rate through its interest rate hikes, but it was able to achieve significant consequences in the U.S. real estate market. Negative consequences, of course.

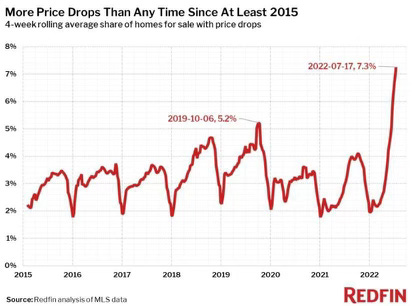

The US New-Home Sales fell for July compared to the previous month by a full 12.6%. Year-on-year, we are now at -29.6%. At the same time, the supply of "New Homes" is soaring to heights we last saw in 2009.

In 2021, the 30-year mortgage rate was 2.65%. The average price of a new home was just under $400,000.

In 2022, we are at a mortgage rate of 5.65% & the average new home costs about $550,000.

This means conventionally, the average home buyer in America will have to factor in a 95% increase in their monthly principal payment.

The number of sellers in the US who have slashed the price of their property has climbed to its highest level in at least 7 years. What’s coming next will not be subtle. What’s coming next will be total economic catastrophe that will cause a ripple effect that will be felt in every major sector in the United States & affect the rest of the world for many years to come.

The worst part is, the Biden Administration is doing nothing to stop it, slow it down, or anything to help mattes. In fact, the Biden Administration has only aided The Great Reset. The Biden Administration has purposefully sped up these horrific numbers. It’s all about shrinking the middle class & taking money away from the poor & handing it right back to the wealthy. The rich get richer & the poor get poorer.

However, there’s ways to prepare yourself for market cycles such as these. There have been more young millionaires made in the last 2 years than in the past 13 years combined. This is a fact. Not because they were wealthy before the Covid lockdowns, but because they had a plan & they executed on it flawlessly. This is why being prepared is so important. So you can position yourself to make money in both bear markets & bull markets. While other people are buying liabilities & junk they don’t need, you should be busy buying assets & opening new streams of income.

We Will Discuss What the Hottest Income Streams Are for 2023 & How to Get Started in Each of Them in our Next Substack Article!

If You Intend to Learn How to Escape the Matrix, You’ve Come to the Right Place. iTrade & Black Ball News Will Show You How to Get There!

Please visit us at iTrade's Website or email us at support@itrade.capital for inquiries!

Thank You For Choosing Black Ball News & God Bless!