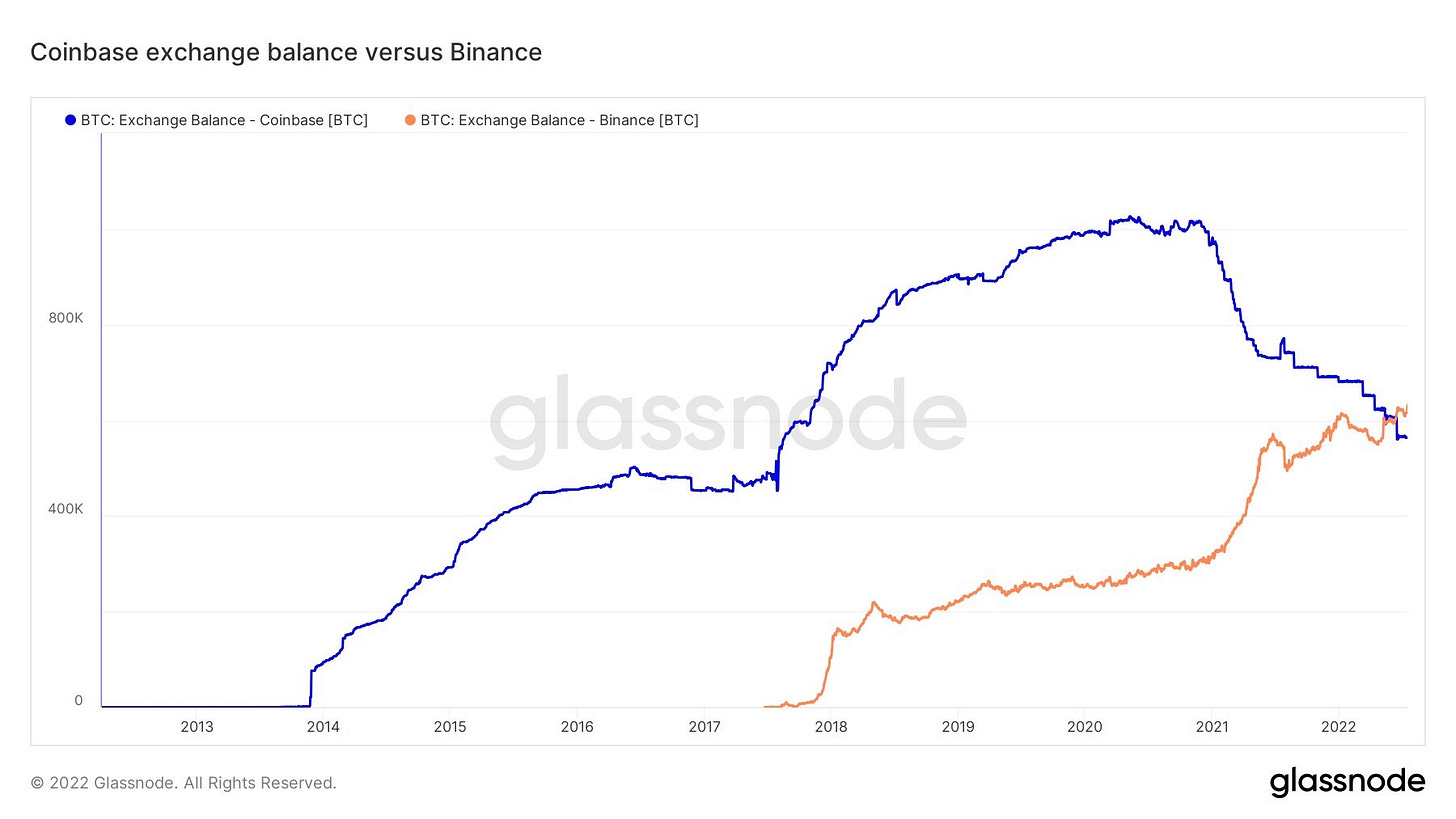

Binance Has Overtaken Coinbase to Become the Largest BTC Reserve Holder in the World

What Exactly Happened?

Data analytics platform Glassnode shows Coinbase Global Inc’s (NASDAQ:COIN) Bitcoin (CRYPTO: BTC) balance has decreased from over 1 million bitcoin in 2020 to less than 600,000 bitcoin today. The decrease has led to crypto exchange Binance now holding more BTC than Coinbase. (Benzinga News)

After Coinbase sent an email out to marketers notifying them that its affiliate program will be halted, rumors circulated the internet that Coinbase may face insolvency, following the insolvencies of Voyager, Celsius, and a number of other cryptocurrency exchanges.

Expect COIN 0.00%↑ to continue to sell off if the company’s stock price breaks below it’s key level of support at $40/share on the Daily & Weekly Timeframes. If we hold price at $40, then expect the stock price to bounce off this support and possibly retest its key level of resistance at $97.25 on the daily & weekly timeframes in the coming weeks/months.

The key difference between Coinbase and insolvent exchanges is how the entities store user funds. According to Coinbase, 98% of digital assets owned by those who use Coinbase are held in cold storage.

Cold storage is the safest way to store digital assets, as it's held in physical hardware, disconnected from the internet. Conversely, Voyager and Celsius lent user funds to other firms, and these firms are now unable to pay back investors.

Meanwhile Genesis Exchange (one of their main competitors) warns of bankruptcy without new funding just yesterday. It’s safe to say the entire crypto sector is under heavy fire. Many exchanges both small and large are on the verge of bankruptcy and almost all of these exchanges are desperately seeking out more funding to keep themselves afloat. This is why so many celebrities have been backing these cryptocurrencies, crypto projects and exchanges. Now the question is, what are they all doing with the funding they have been receiving?

Ex CEO of FTX, Sam Bankman-Fried, is expected to sing like a bird, and in turn, rattle the cage once he talks to the FBI, the SEC, the Southern District of New York, and his upcoming bankruptcy trial in Delaware.

Coinbase is expected to survive the current crypto bear market, while smaller exchanges are expected to financially struggle. Coinbase has survived crazy downturns in the past and the exchange is relatively risk averse compared to BlockFi, KuCoin, Celsius, Lobstr, and Genesis platforms.

Events like these are meant to teach the public that your personal crypto holdings are not safe sitting on these exchanges. This is why cold storage is becoming so popular. With a cold storage wallet your funds are protected by your own set of private keys, offline, and on a secured ledger device like a Trezor, or Ledger Nano S drive. Keeping your money on the exchanges for extended periods of time is a recipe for disaster. If these crypto exchanges go bankrupt overnight you have the potential to lose all funds sitting on their platform.

So What’s the Lesson Here?

If you’re not actively trading crypto, keep your funds on a cold storage wallet. That way only you can access it in a secure manner and have peace of mind that your crypto investments are indeed safe.

We humbly appreciate your support & ask that you continue to use Black-Ball News!

Please visit us at iTrade's Website or email us at support@itrade.capital for inquiries.